Filing your income tax might not be fun but we all have to do it anyway. If your yearly income is above RM34,000, you definitely can’t escape it.

You can already start doing your taxes but the deadline for e-Filing (BE Form—resident individuals with no source of income from running a business) is 15 May 2021.

What can make it fun is finding out the tax reliefs and rebates that you can claim so you could potentially either pay less tax or get a refund. There are three main groups of Malaysians who can claim these tax reliefs/rebates:

1. Single individuals

2. Married couples with parents

3. Those with children

From your SOCSO contributions to lifestyle purchases, here’s a quick guide on how you can get money back from your income tax.

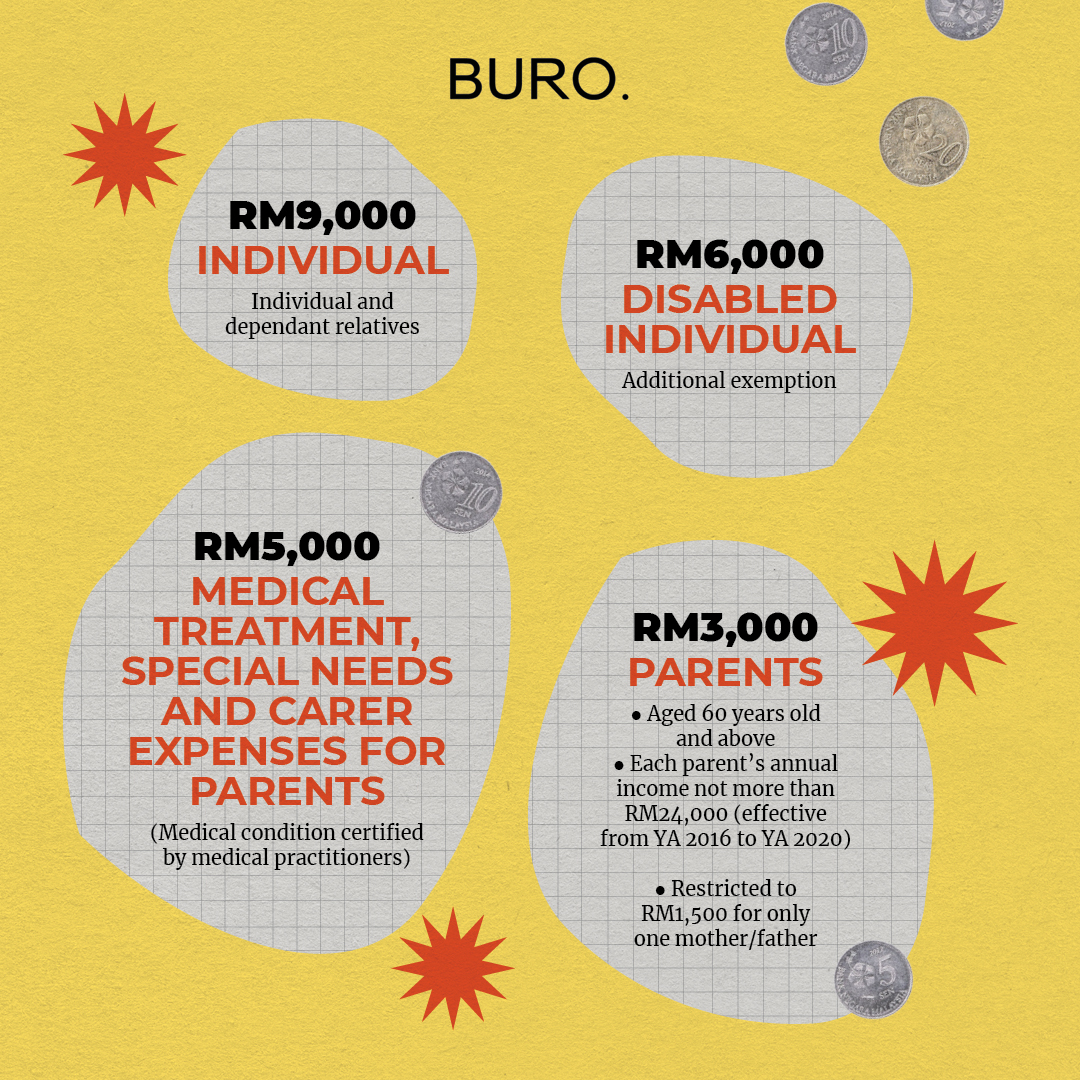

Individual: RM9,000

This will automatically be included as a tax relief for individuals.

Disabled individual: RM6,000

This tax relief is applicable for individuals who are disabled and registered with the Department of Social Welfare (JKM).

Medical expenses for parents: ≤RM5,000

If you are paying for your parents’ medical treatment, special needs and/or carer expenses, you’re eligible to claim up to RM5,000. However, it has to be for a medical condition that requires specific treatments and can be certified by a medical practitioner.

Expenses for parents: RM1,500 per parent (or RM3,000 for both)

Claim up to RM3,000 if your parent(s):

- Is your biological parent(s)

- Is a resident in Malaysia and aged 60 and above

- Was not claimed under the ‘Medical expenses for parents’ category

- Does not have an aggregated annual income of above RM24,000

If you have a sibling (or more) who is also claiming for the same parent(s), the claimable amount will have to be divided equally.

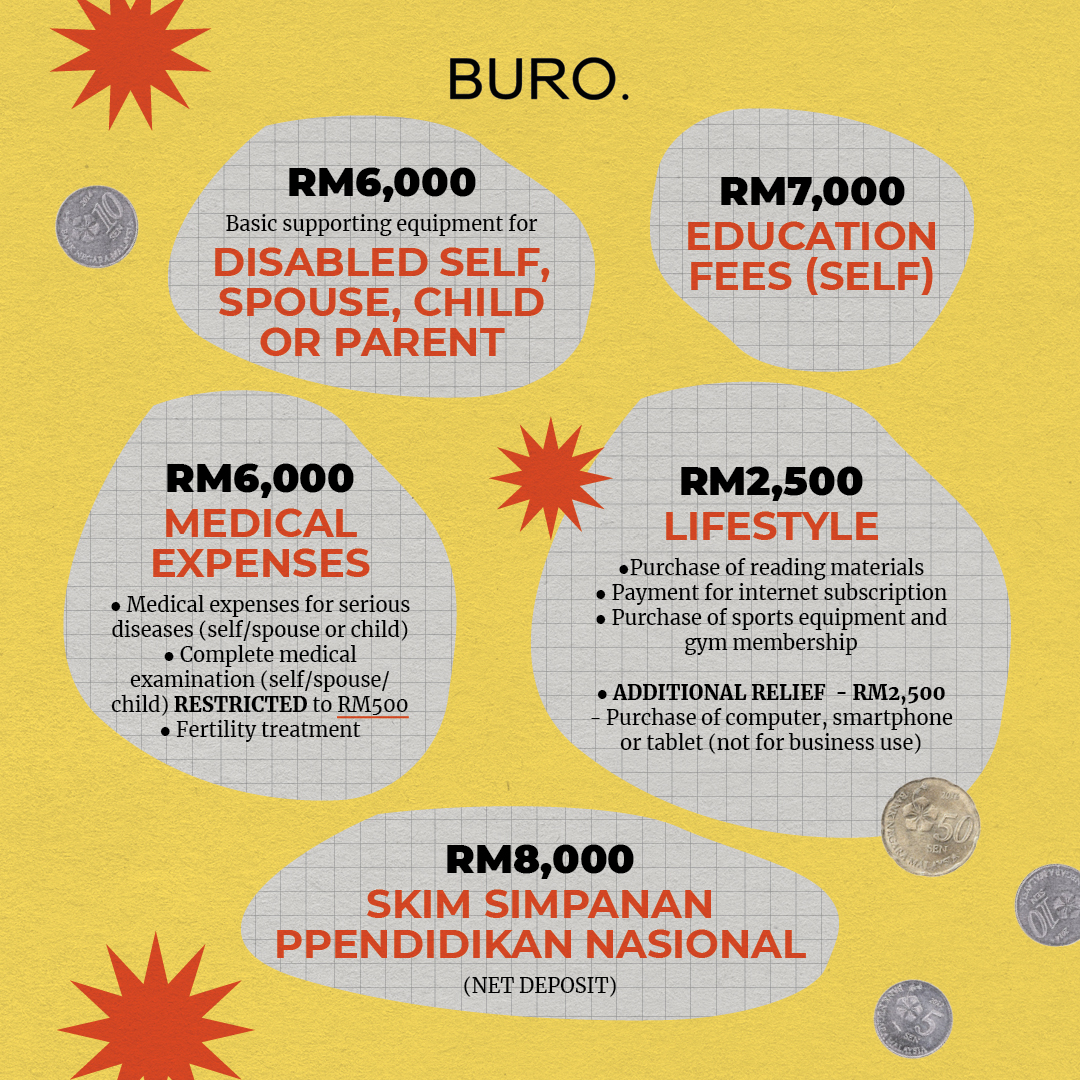

Basic supporting equipment for disabled self/dependants: RM6,000

Purchases of supporting equipment for disabled self or dependants (disabled spouse, children or parents) are eligible for a tax relief of up to RM6,000. However, similarly, the disabled individual/dependant(s) have to be registered with the Department of Social Welfare (JKM).

Education fees (self): RM7,000

Eligible if you are paying for your own course of study at a recognised institution in Malaysia that applies to either:

- Masters or Doctorate: Any course

- Non-Masters or Doctorate: Courses in law, accounting, Islamic financing, technical, vocational, industrial, scientific or technology

Medical Expenses: ≤RM6,000

- For serious diseases* for self, spouse or child

- Medical expenses for fertility treatment for self or spouse

- Complete medical examination for self, spouse, child (restricted to RM500)

*Examples of “serious diseases” include AIDS, Parkinson’s disease, cancer, leukaemia, heart attack, major organ transplant, etc.

Lifestyle—for self, spouse or child: ≤RM2,500

Who knew your lifestyle expenses could be quite rewarding. This category applies to:

- Books, journals, magazines, printed newspapers and other similar publications

- Personal computer, smartphone or tablet

- Payment of your monthly internet bill/subscription (under own name)

- Gym memberships and purchase of sports equipment (for sports activity defined under the Sports Development Act 1997)

Lifestyle—tech: ≤RM2,500

If you purchased a computer, smartphone or tablet for yourself, a spouse or child—and they’re not for business use—you’ll be eligible for additional tax relief*.

*Applicable for purchases made within the period of 1 June 2020 to 31 December 2020. This was added to aid those who had to switch to WFH or online schooling during the MCO period.

Skim Simpanan Pendidikan Nasional: ≤RM8,000

Also known as SSPN, it’s a savings plan for parents to invest in their children’s higher education.

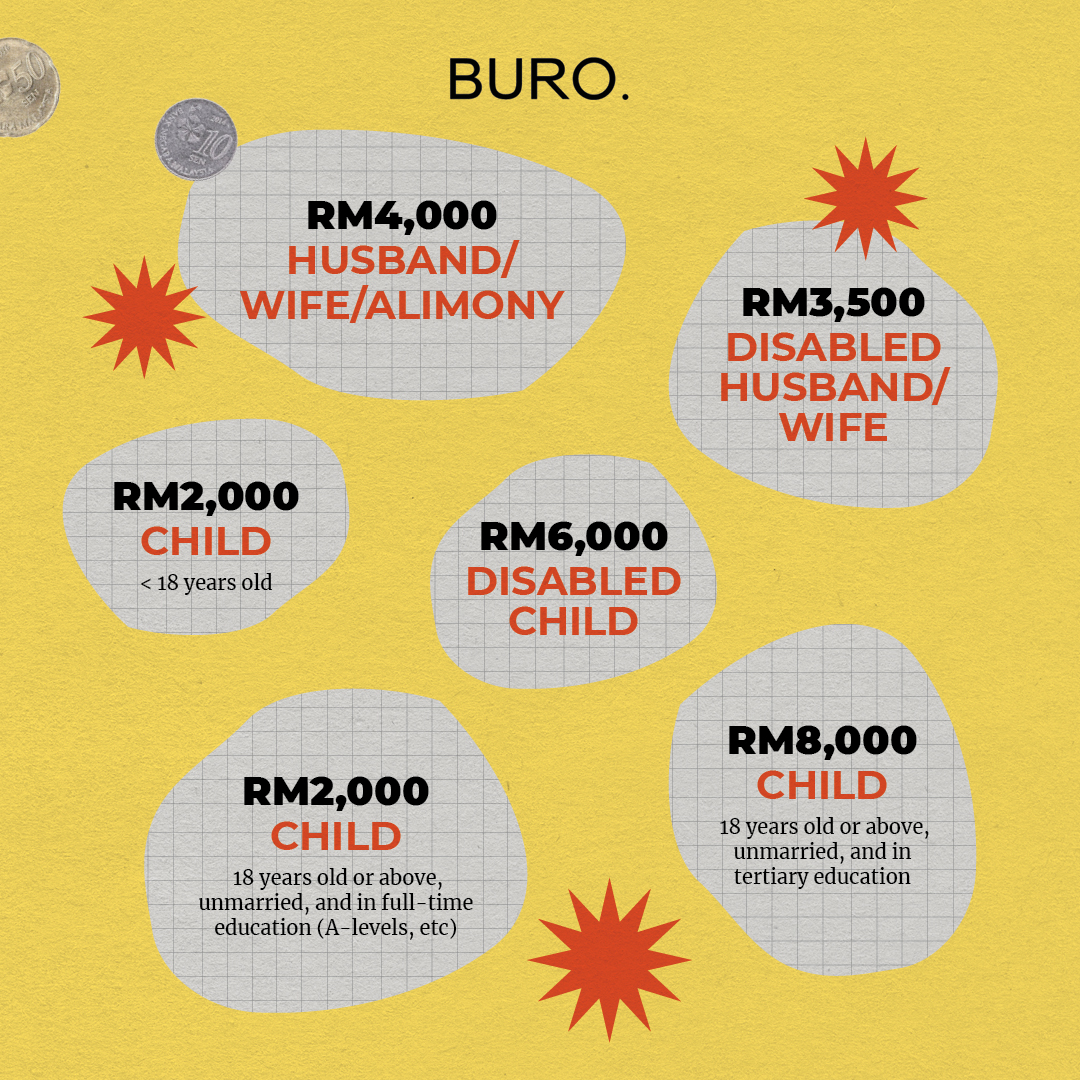

Husband/Wife/Alimony: ≤RM4,000

For those with a spouse who has no source of income or doesn’t earn a taxable income. This applies to husbands who pay an alimony* to their ex-wife as well.

*Note that you’ll need formal agreements to prove this arrangement

Disable husband/wife: RM3,500

Disable child*: RM6,000

Regardless of age.

*If your disabled child is 18 years old and above, unmarried, and pursuing higher education in Malaysia or overseas, you can get an additional exemption of RM8,000.

Child (Below 18 years old): RM2,000

Each unmarried child who is under the age of 18 years old.

Note: This can only be claimed by either the mother or father.

Child (18 years old and above): RM2,000

Each unmarried child who is 18 years old and above, and who is receiving full-time education (A-Levels, certificate, matriculation or preparatory courses).

Child (18 years old and above): RM8,000

Each unmarried child who is 18 years old and above, and who is pursuing tertiary education:

- A diploma or higher (excluding matriculation/ preparatory courses) in Malaysia

- An undergraduate, Master’s, or Doctoral degree (or its equivalent) from overseas

- Any courses at institutions of higher learning recognised by the Ministry of Higher Education (MOHE).

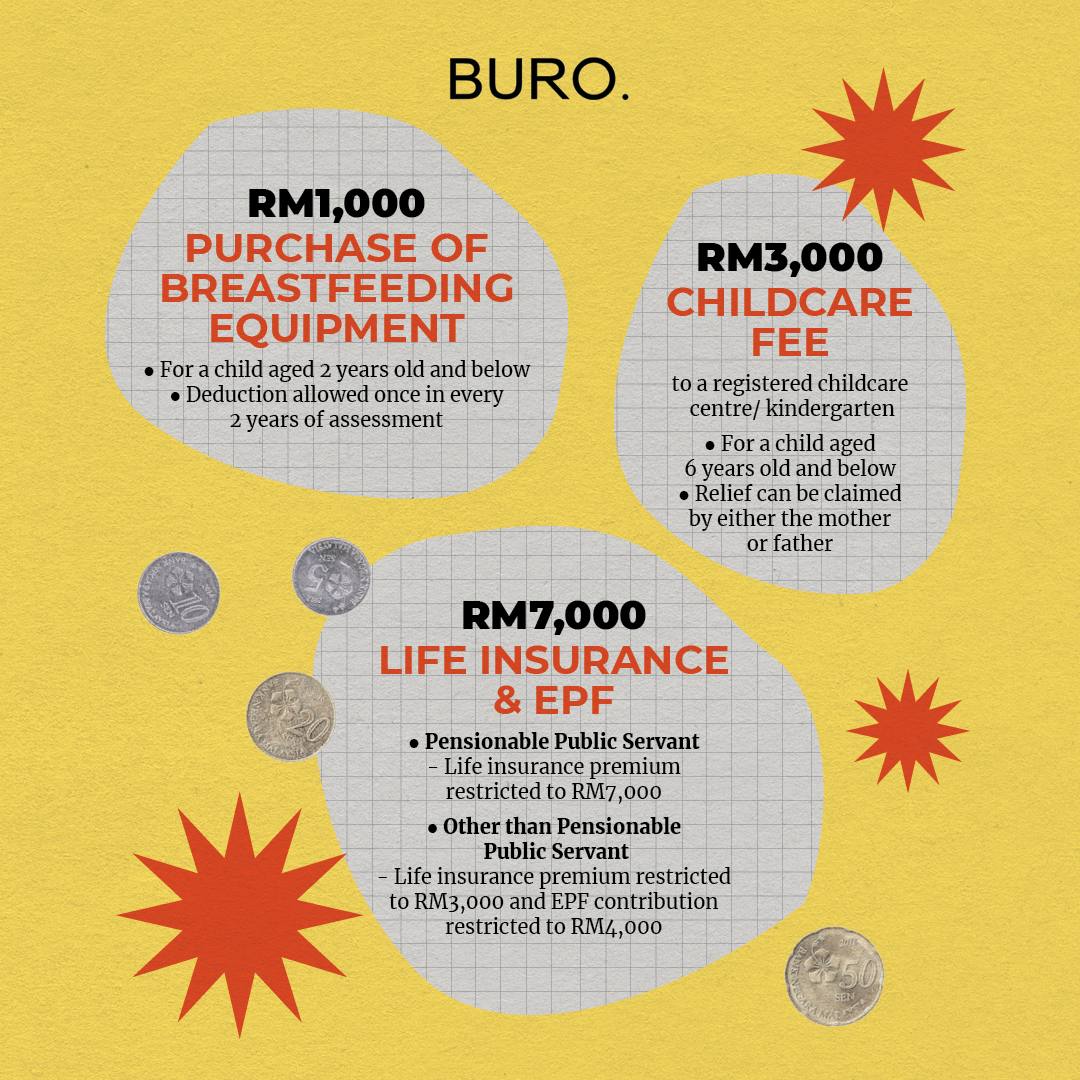

Breastfeeding equipment: ≤RM1,000

If you’ve purchased breastfeeding equipment for your child aged two years and below, you’re eligible for this tax relief. However, this deduction is only allowed once in every two years of assessment.

Childcare fee: ≤RM3,000

Previously set at RM1,000, this tax relief has been increased to a limit of RM3,000 for parents sending their kids to a childcare centre or kindergarten. This deduction can only be claimed by either the mother or father.

Life insurance and EPF: ≤RM7,000

This is divided into:

- Pensionable public servant category — Public servants can claim up to RM7,000 for their life insurance premium

- Other than pensionable public servant category — Non-public servants can claim based on two sub-categories: Life insurance premium (≤RM3,000) and EPF (≤RM4,000)

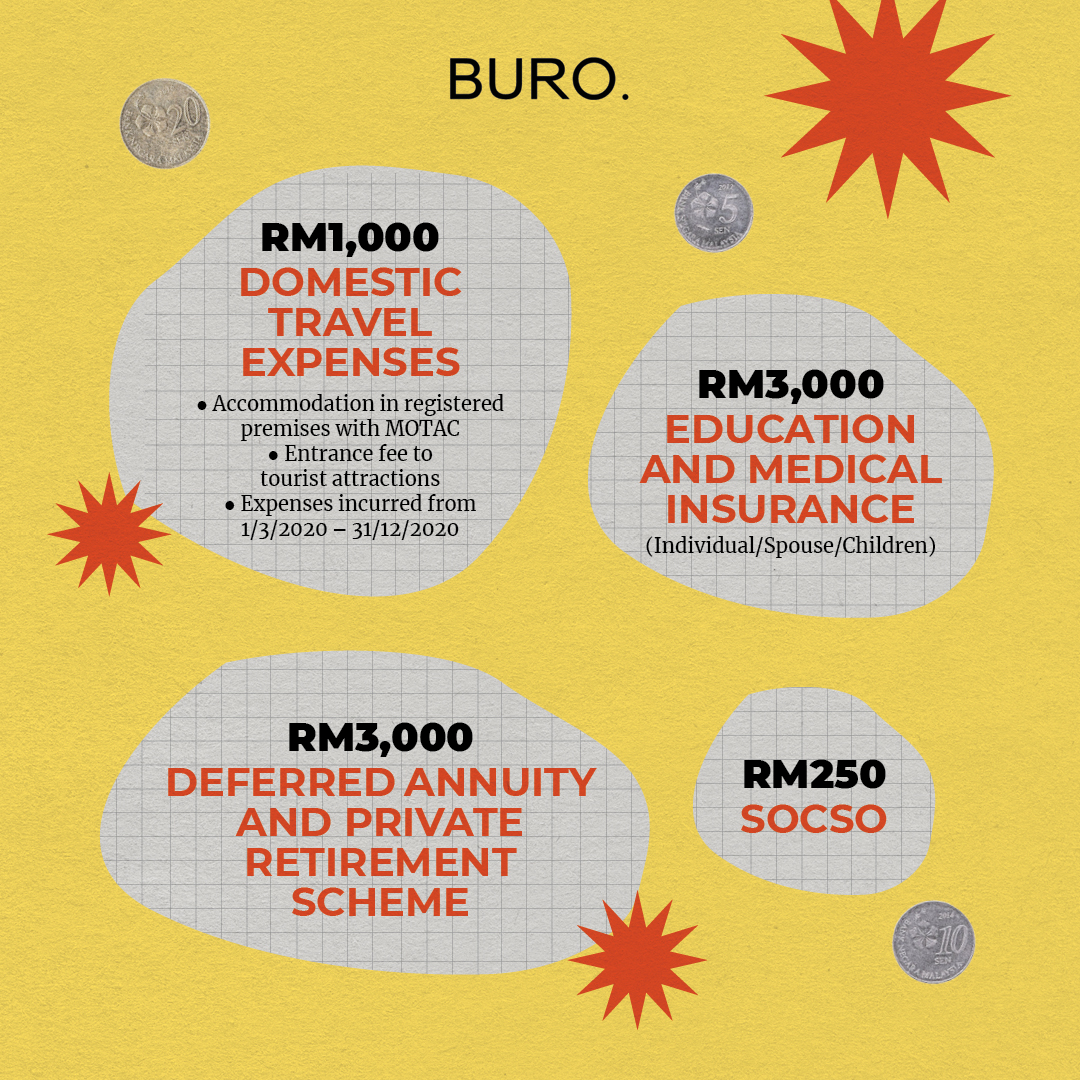

Domestic travel expenses: ≤RM1,000

Don’t forget to claim this tax relief if you’ve stayed at an accommodation registered with the Commissioner of Tourism OR paid entrance fee(s) to a tourist attraction.

Note: This only applies to expenses incurred on or after 1 March 2020

Education and medical insurance: ≤RM3,000

This is different from your life insurance premium. Claimable if you paid for any insurance premium related to education or medical for yourself, spouse or child.

SOCSO: ≤RM250

Your contribution to the Social Security Organisation is eligible for tax relief too. You’ll need your EA form for this (ask your HR if you haven’t received it yet). Enter the amount stated under it on your form.

Deferred Annuity and Private Retirement Scheme (PRS): ≤RM3,000

Keep your receipts!

This is more of a tip. For all the things mentioned above or included in the infographic, ensure you’ve kept all the receipts—even after you’ve filed for your income tax. You never know if you’ll be picked for auditing by the Inland Revenue Board so having these receipts will at least help to back your claims and avoid any penalty fees. The general rule is to keep them for at least seven years from the year of filing.

Source: RinggitPlus, VulcanPost, The Star

For more info, visit the Lembaga Hasil Dalam Negeri website.

| SHARE THE STORY |