This motor insurance policy is tailored specially for women—here’s everything to know

Safety first

Road safety is a concern for all road users regardless of gender, but women tend to face greater risks on the road. For example, women are more often the targets of hijacking, assault, and snatch theft. Given these circumstances, it’s crucial for female drivers to understand how they can stay as protected as possible while on the road.

One common rule of thumb is to always lock all doors and ensure windows are rolled up. Always be cautious at intersections and traffic lights, as this is where a car is most vulnerable. Beware of strangers that walk up to your car and do not wind down your window except when requested to by the authorities. If you must, roll down your window only a few centimetres or just enough to hold a conversation, but stay wary of assault or threat.

In addition, it’s advisable to keep valuables such as laptops and handbags out of sight. This reduces the likelihood of smash-and-grab thefts. Some thieves may even use the element of surprise to distract a driver while their partner grabs their belongings from the other side. When in doubt, do not engage with strangers and drive away if you can.

Another important safety net to consider is having a motor insurance policy with relevant add-ons that safeguard a woman’s need for greater peace of mind. This is the gap MSIG Malaysia’s Lady Motor Plus Insurance was created to fill—here’s everything to know.

What is MSIG Lady Motor Plus Insurance?

MSIG Lady Motor Plus Insurance is a comprehensive motor policy with additional coverage developed for female vehicle owners aged 17 years and above with a valid driving licence. In a nutshell, it covers loss or damage to a policyholder’s vehicle and liability to other parties for injury or death, as well as accidental/fire damage or theft of a policyholder’s vehicle and damage to other parties’ property.

What does the policy cover?

- Comprehensive Cover

This includes third party death or injury, third party property loss or damage, loss or damage to vehicles caused by theft, fire, or accident.

- Full Special Perils

Typically available as an add-on to standard insurance policies, this provides coverage of the car for loss or damage due to flood, landslides, sinking of the soil/earth, among other culvulsions of nature.

Note: The following highlighted features are exclusive to this package.

- Policyholder Personal Accident

The policy offers additional RM50,000 worth of coverage against death or permanent disability due to a road accident. This applies whether the policyholder is driving or being driven.

- Inconvenience Relief Allowance

A one-time sum of RM1,000 is provided when the insured car is stolen, damaged by flood, or suffered a total loss.

- Loss or Damage to Personal Belongings

A one-time compensation of RM1,000 is provided for the loss or damage to the belongings of the policyholder or an authorised male or female driver due to an accident or snatch theft.

- Transportation Allowance

The policyholder is entitled to an allowance of RM100 to cover transportation expenses when the insured car is being towed to a workshop for a repair after a road accident.

Other Motor Add-on features such as Windscreen Cover, Smart Key Shield, and Waiver of Compulsory Excess are also available for additional protection.

Why do I need the additional coverage provided in this policy?

For many female vehicle owners today, driving is part of their lifestyle—be it commuting to work, heading to the grocery store, driving out to meet friends, or going on a road trip. With so many roles to embrace and things to do, it is important that your insurance is a good fit for you.

At the end of the day, nobody wants to be in an accident, but in the unfortunate event that you are, this policy helps to get you back on your feet faster.

How much premium do I have to pay?

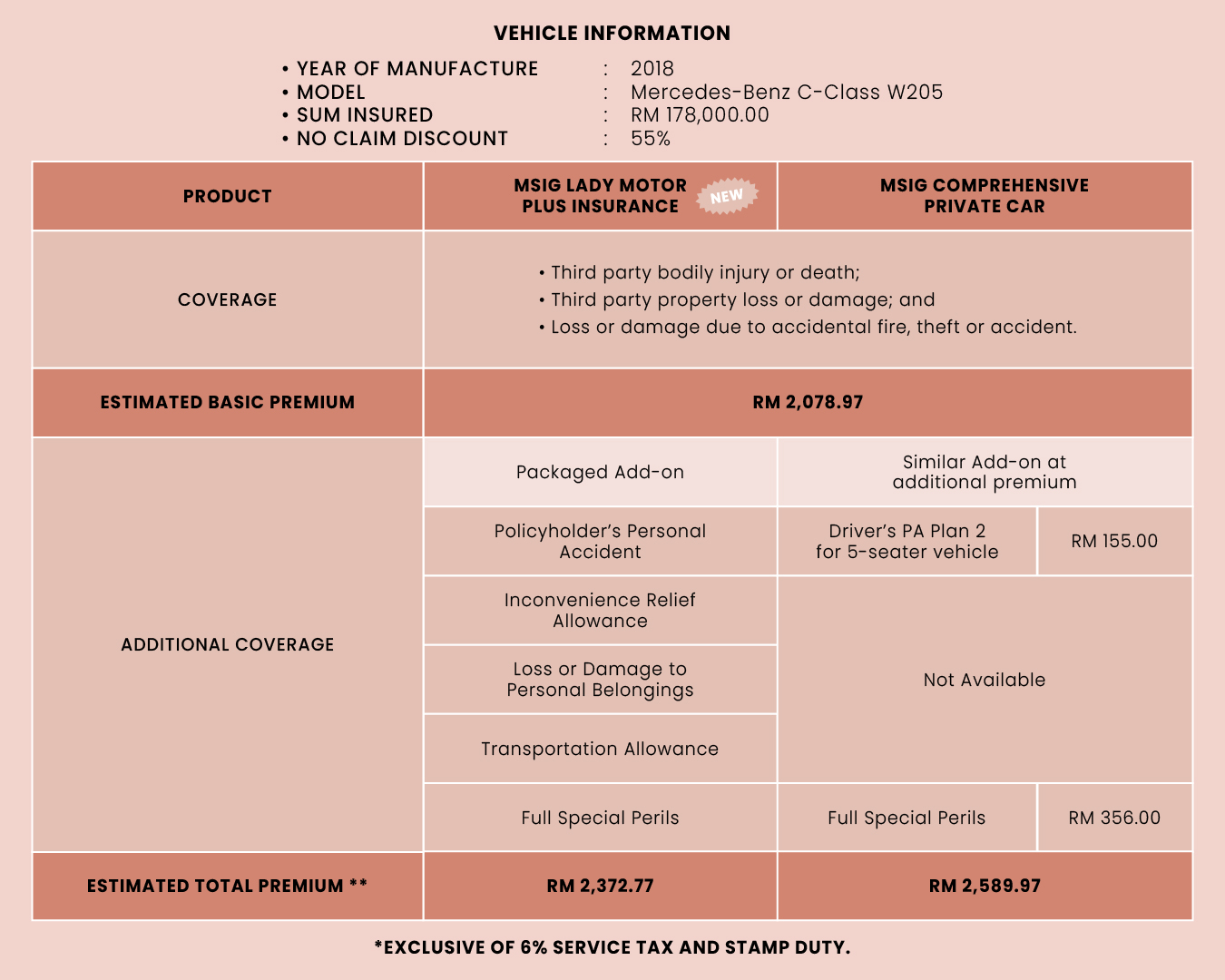

Generally, the premium you are required to pay is based on risk characteristics such as age, type of vehicle, your track record as a driver, your job, and so on. As MSIG Lady Motor Plus is a packaged product, you are able to get greater coverage for a better price. A sample is provided by MSIG below, comparing the purchase of the basic Comprehensive Private Car insurance and that of MSIG Lady Motor Plus:

What should I do in the event of damage due to an accident?

Always lodge a police report first. Whether it is an accident, smash-and-grab theft, or hijacking, make sure that you are safe and that the proper authorities have been contacted. After that, you should contact MSIG through your MSIG Insurance Adviser or by calling the Motor Assist Hotline (1-300-880-833). The Lady Motor Plus policy entitles you to MSIG’s accident/roadside service assistance at no additional cost as per your policy coverage. Alternatively, MSIG offers the MY MSIG Mobile App for policyholders to easily get in touch, make and track claims through to the end.

For more information about MSIG Lady Motor Plus insurance, contact the MSIG Customer Service Hotline at 1-800-88-6744, email [email protected] or visit the MSIG website.

Location: MSIG Insurance Malaysia Bhd, Level 15, Menara Hap Seng 2, Plaza Hap Seng, No. 1, Jalan P. Ramlee, 50250 Kuala Lumpur

*Terms and conditions apply

Find more insurance stories here.

| SHARE THE STORY | |

| Explore More |