As much as we work hard for our money, scammers work hard to fool us out of it too. Scammers often find preys through the variety of financial and telecommunication services as well as online and social media platforms available today, which make them appear convincing even to the less gullible among us.

With that said, it’s not practical to steer clear entirely of these conveniences that are designed to improve our quality of life. Instead, the first step to avoiding a scam is to be aware of the modus operandi of scammers and be proactive in ensuring your privacy and security.

To help keep you on your toes, here are five common types of scams in Malaysia and the red flags to take note of to protect your personal information and hard-earned money.

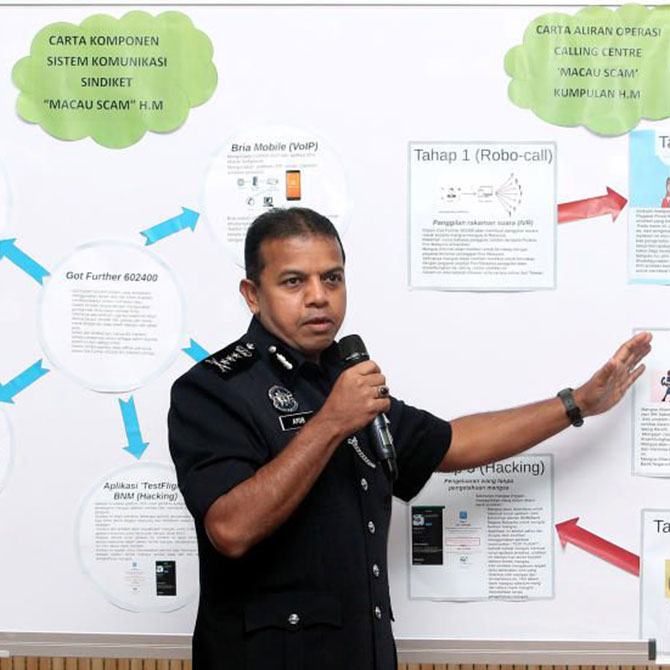

Macau scam

The Macau scam is a type of telecommunications fraud that usually involves a phone call from someone who claims to be a government official, police, or bank officer. The caller may be able to provide your full name or other personal details to sound credible, before alleging that your account has been compromised or linked to crimes and money laundering activities. They will then advise or request for you to make a fund transfer to avoid being blacklisted or having your bank account frozen.

There are variations to this tactic, but the general idea is to scare potential victims into thinking they’re in trouble to perform transactions out of panic. According to The Star, this type of scam has managed to con Malaysians out of RM256 million in 2020 alone.

Red flags:

- The person impersonates a bank or court official, policeman, or post office staff

- The person pressures you into making an instant transfer to a specific account “for investigation purposes”

- The person asks you for personal information such as your debit/credit card number, identification card number and CVV

What to do:

Stay calm and do not panic. Ask for their identity verification and insist on meeting at the police station or in a protected public space. If the caller insists on immediate payment or threatens action, hang up the phone. Do not make any transfers or call any number provided during the phone call.

BigPay scam

For the unfamiliar, BigPay is a payment system owned by AirAsia that allows users to make a payment via a prepaid card or mobile app. Scammers typically impersonate a BigPay staff, asking for your personal details and OTP to claim your prize or upgrade your card. Although the company has released several statements on these scams since last year, perpetrators have still not given up on this tactic (this writer got a call from “BigPay” just a few weeks ago; thankfully, I was well-aware of their schemes then).

Scammer: “So we just need your OTP/card details….”Us: pic.twitter.com/66f7Z4aT9C

— BigPay (@bigpaymeapp) July 13, 2021

Red flags:

- The person is contacting you via WhatsApp, claiming to be from BigPay

- The person asks you for personal information and a one-time password (OTP) that was sent to your number

- The person offers you a red, limited-edition, or platinum card apart from the standard blue card

What to do:

As with the Macau scam, hang up the phone immediately. Do not provide any personal information, especially not your OTP! Block the phone number and report any suspicious activity to BigPay via the in-app chat or email. For more information on the BigPay scam, read the official post from BigPay here.

Social media scams

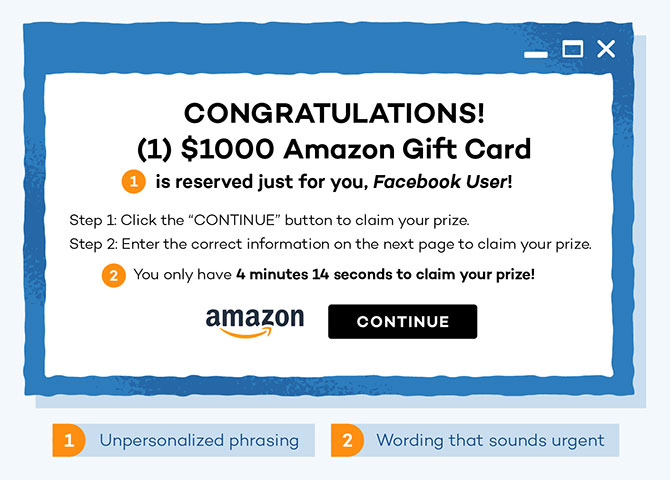

There are many different forms of social media scams, but arguably the most common of all is the phishing scam. Phishing is a type of cyberattack where perpetrators impersonate legitimate organisations or individuals you may know via email, text, direct messages, advertisements, or other means to trick you into revealing sensitive information. These impostors will often entice you by claiming that you have won a prize or giveaway, then provide a malicious link that may lead to ransomware, malware, or request for your personal information.

For example, scammers recently tried to impersonate BURO Malaysia’s account, claiming to be handled by our management team. We strongly urge our readers and consumers to always look for the red flags below.

View this post on Instagram

Red flags:

- The sender is using a personal email address, a misspelt name, or an email address with additional space characters such as an underscore, hyphen, or period

- The email, message, text, or promotional content contains a suspicious or shortened link

- On social media, scam accounts are usually private, unverified (no blue tick), and/or are not followed by the official account that they claim to be affiliated with

What to do:

Ignore or delete suspicious emails and messages. Do not click into any links or provide personal information before verifying it with the legitimate businesses, organisations, or individuals through the proper contact channels. Block and report fake social media accounts to alert the respective platforms and relevant parties of suspicious behavior.

Employment scams

Sadly, some cunning crooks have taken advantage of increased unemployment rates during the pandemic to advertise fake job listings to desperate job seekers. These scammers often advertise on social media, job sites, or WhatsApp messages with attractive (questionable) renumerations but little information about the job, with the intention to trick potential victims into providing personal information or transferring their money to secure said job.

Red flags:

- The ‘employer’ requests for money remittance before the job interview or confirmation of job offer

- The job advertisement offers a high pay for little work (compared to standard market rates)

- The job description is vague, poorly written, or very unprofessional

What to do:

Do a background check on both the employer and recruiter to check if they have a reputable website, professional references, reviews, or social media presence. Don’t pursue the job offer if something doesn’t add up (it’s unlikely to exist in the first place). Ignore further requests or block or report the contact immediately.

Romance scams

Last but not least, there are romance scams, also known as catfishing. This is another popular scam during the pandemic, where fraudsters prey on single, lonely individuals online through social media and dating apps. These romance scammers often try to win the hearts of potential victims to trick them into transferring money, though some scammers may do so as an attempt at manipulation, revenge, or entertainment rather than for money.

Red flags:

- The person works somewhere far away, such as overseas, in the military/navy, or an international organisation

- The profile has a far higher following count than follower count, and either little to zero posts or many posts that are within a short timespan from each other

- The person refuses to meet in person/show their face and breaks promises to visit

- The person suddenly requests for money for a medical emergency or personal crisis

- The person professes their love too quickly and tries to move too fast in the relationship, such as texting or calling you several times a day

What to do

Search up the person’s name, image, and/or profile on a different platform to the one you met them on to check if it’s associated with another person or with details that don’t match up. Do not ever transfer money to or share sensitive information with an online love interest, especially one you’ve never met. Slow down and confide in someone you trust about the relationship and take their advice into consideration. If there’s more than one red flag, stop all communication and block or report the contact.

Three golden rules

Generally, here are the three key points to remember when you’re faced with any suspicious activity or potential scams:

1. Always perform background checks

Whether the scammer is claiming to be a government official, a business or bank representative, a relative, a friend, or a love interest, stay calm and vigilant. Don’t let your guard down or jump into rash decisions. Ask questions to verify their identity and perform your due diligence to check with the relevant channels before taking any action.

2. Never provide personal information over text, call, or email

Legitimate businesses, organisations, and officials will never ask for your personal data over text, call, or email out of the blue. Do not share sensitive information through these channels.

Do some good today and share this tweet to remind your friends and family to NEVER share their OTP or details with anyone Remember, we will never ever call you on WhatsApp!#StaySafe by blocking and reporting the numbers to us via in-app chat

— BigPay (@bigpaymeapp) July 9, 2021

3. If something sounds too good to be true, it probably is

As much as we’d all like to strike the lottery, win attractive prizes, or find the love of our life, it’s always safer to err on the side of caution. Whenever an exciting offer comes your way, pause and remember: you can’t win a contest you’ve never joined; you shouldn’t give money you don’t have in order to “earn more”; and you should never blindly trust strangers you’ve never met.

Now that you’re aware of these scams, do alert your friends and family members, especially senior citizens, who may be gullible towards the devious schemes of scammers.

For more stories like this, head over here.

| SHARE THE STORY |