Warren Buffet once said: “If you don’t find a way to make money while you sleep, you will work until you die.” We expect nothing less from one of the most—if not the most famous and successful investors in the world—but not everyone has the means or stomach for investment as he does.

Thankfully, we live in an era where automated investment exists. This means you can still make money while you sleep, even if you don’t have a capital that’s even a fraction of a percentage of Buffet’s net worth (the last time we checked, Forbes said it’s US$100 billion).

You may be familiar with conventional forms of automated investments such as fixed deposits, unit trusts, and the employee provident fund (EPF); but there are other newer digital platforms that can offer a higher return and/or greater benefits for the same amount of money invested. Among the benefits include lower management fees (compared to traditional options), and a more diversified investment portfolio.

These fintech platforms include, but are not limited to robo-advisors and peer-to-peer lending (aka P2P financing). Here’s a brief introduction to how each of them work, along with a list of apps available in Malaysia to help you grow your wealth passively.

Robo-advisors

Robo-advisors are designed to provide automated, algorithm-driven investment services based on an investor’s goals and risk appetite. Essentially, a robo-advisor offers the same services as a human financial advisor, but often with lower barriers to entry and lower management fees. Plus, investors can monitor and change their preferences and goals on the app in real-time. Depending on the financial information that you provide a robo-advisor (age, income, goals, risk index, and the like), it may recommend a variety of assets for investment, including:

- exchange traded funds (ETFs)

- shares (in different markets/regions/ industries)

- bonds/sukuk

- property/real estate/REITs

- cash/currencies

- gold

1. StashAway

StashAway is one of the leading robo-advisors in the market that was founded in Singapore in 2016 before expanding into Malaysia in 2018. It is favoured for its easy-to-use interface (UI/UX) and customisable goals and risk index, with potential earning returns of up to 17.6 per cent. Plus, there’s no minimum deposit and no lock-in period, so investors have full discretion on how much to invest while having the freedom to withdraw funds at any time. All these benefits are offered with a management fee of only 0.8 per cent per annum.

Available on: App Store, Google Play and Huawei App Gallery

For more information, visit the website.

2. Mytheo

Mytheo is the Malaysian arm of Theo, which is the first robo-advisory service in Japan. It invests mainly in ETFs which have exposure to over 10,000 companies from more than 86 countries. Funds are allocated into three Functional Portfolios: Growth, Inflation Hedge and Income, each with its own purpose and targeted benefit. This can be automated for you or tailored to your preferences. Mytheo charges a tiered rate of between 0.5 to 1 per cent per annum on your investment value, which starts at a minimum deposit of RM100.

Available on: App Store and Google Play

For more information, visit the website.

3. Wahed Invest

Founded in New York, Wahed Invest is one of two shariah-compliant robo-advisor platforms in Malaysia. It offers seven different portfolio types that range from very conservative to very aggressive, with investments allocated mainly in shariah-compliant securities and sukuks (Islamic bonds), as well as gold. There’s a minimum deposit of RM100 with no lock-in period. Charges include either a minimum monthly fee of RM2.50 or an annual fee of between 0.39 to 0.79 per cent, whichever is higher.

Available on: App Store and Google Play.

For more information, visit the website.

4. Best Invest

Best Invest is the other shariah-compliant fintech company in Malaysia, which applies both robo-intelligence and big data to develop an investment portfolio of diverse unit trusts for investors. It is backed by BIMB Investment, which is a fully owned subsidiary of Bank Islam Malaysia Berhad. The minimum deposit is RM10 with no lock-in period. Annual management fees range from 0.5 to 1.8 per cent, depending on your investment value.

Available on: App Store and Google Play.

For more information, visit the website.

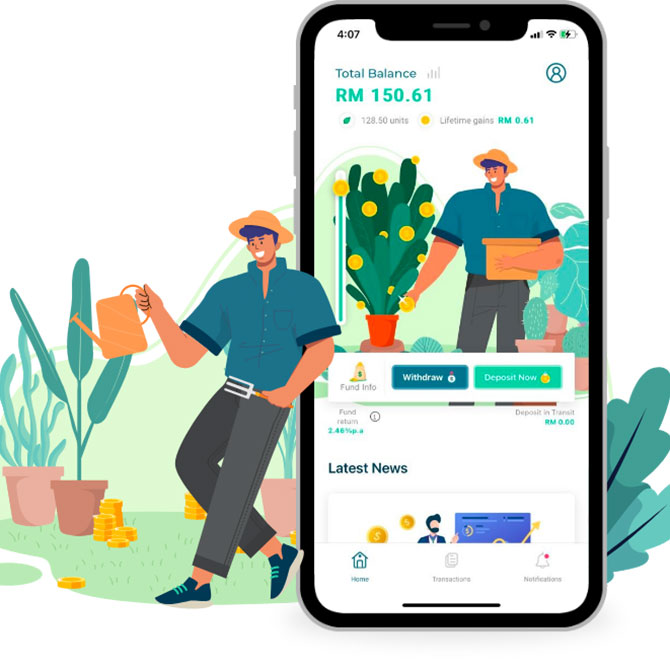

5. Raiz Malaysia

Raiz Malaysia is a joint venture between Raiz Invest Limited, an Australian fintech startup, and Jewel, which is a wholly own subsidiary under Permodalan Nasional Berhad (PNB). Its investments are tied to Amanah Saham Nasional Berhad (ASNB)’s unit trust funds. These funds are not certified as shariah-compliant, but are deemed “permissible” by local Islamic councils. A key feature that sets Raiz apart is round-ups, which automatically rounds up your transactions to the nearest ringgit via a debit card connection, then invests the change into a diversified portfolio. A lump sum deposit is also possible, with no minimum requirement (although a minimum balance of RM5 is required to start investing). A fee of RM1.50 a month (for investments under RM6,000) or 0.3 per cent per annum (for investments above RM6,000) applies.

Available on: App Store and Google Play

6. Akru

Founded and based in Malaysia, Akru prides itself in a strong team of individuals from investment banking and finance management backgrounds. The robo-advisory platform invests in a range of diversified global low-cost exchange traded funds, with 10 different portfolios for varying risk appetites. There is no minimum deposit required, but a RM10 admin fee is charged to open an account. Annual fees are priced between 0.2 to 0.7 per cent, depending on the investment value.

Available on: Akru website

For more information, visit the website.

Peer-to-peer lending

Peer-to-peer lending is exactly as it sounds—it allows an individual to provide/obtain a loan from other individuals, cutting out financial institutions as the middleman. Investors earn a return on their principal (also called a “note”). While this type of investment (like most others) comes with its risks, P2P platforms typically use proprietary systems that qualify borrowers based on credit scores and debt-to-income ratios. Riskier individuals are charged a higher interest to investors, while high-rated borrowers (who are less likely to default) will be charged less interest. Investors can either manually choose which “note” to invest in, or allow robo-advisors to choose for them based on their investment and risk profile.

1. Funding Societies

Funding Societies is Malaysia’s first and biggest P2P lending platform which provides funding to SMEs around Southeast Asia from both individual and institutional investors. In return, investors receive monthly repayments of principal plus interest. Investors may deposit a minimum of RM100 with a lock-in period of between one to 24 months to earn a projected interest of up to 14 per cent per annum. Funding Societies charges 18 per cent on interest as its service fees.

Available on: App Store and Google Play

For more information, visit the website.

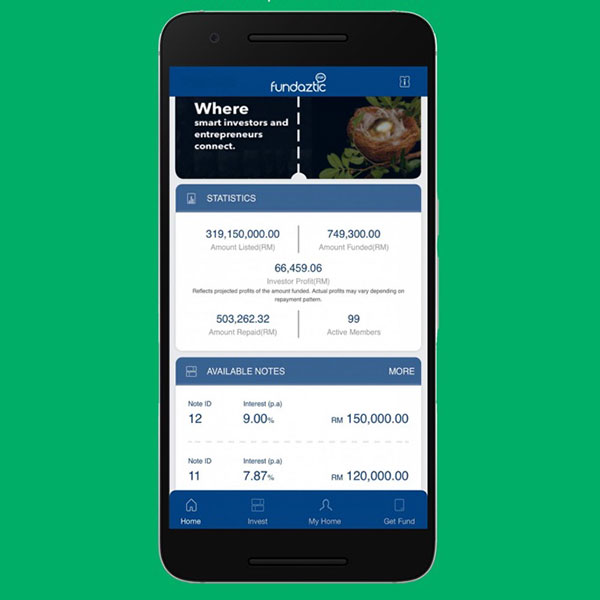

2. Fundtaztic

Fundaztic provides access to financing and investment for businesses and individuals, with amounts ranging from RM20,000 to RM200,000. Repayment periods are between three months to 36 months and interest rates start from 8 per cent per annum. Investors can select notes to invest in based on their preferred risk profile, tenure and interest returns. Fundaztic charges 2 per cent on monthly repayments and 1 per cent on bullet repayments, on top of withdrawal processing fees of up to RM1.

Available on: App Store and Google Play

For more information, visit the website.

Cash management

Cash management is a broad term for any kind of service that helps users manage their cash and assets, not necessarily just for investment purposes. However, for the purpose of this article, we specifically refer to cash management platforms that are designed as an investment alternative to fixed deposits. These platforms offer a lower risk compared to robo-advisors and P2P financing, while providing returns that are on-par with fixed deposits with a few extra perks.

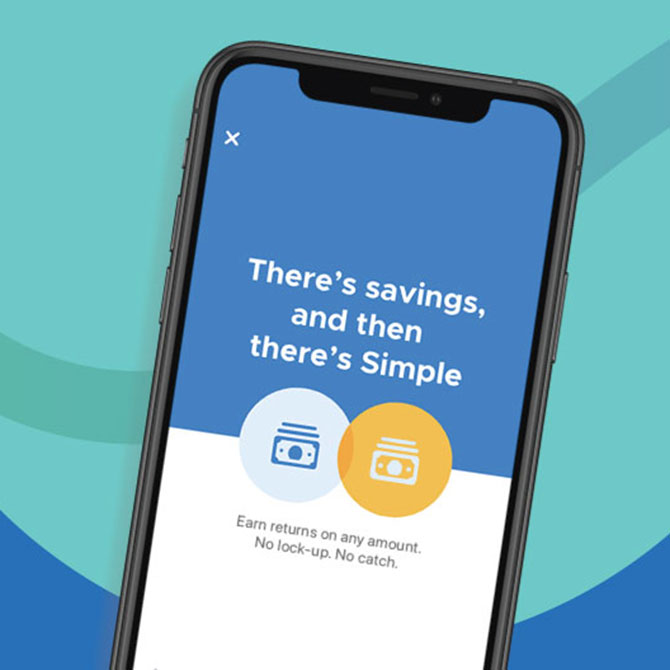

1. StashAway Simple

Part of the appeal of Stashaway to investors who have a lower risk appetite comes in the form of Simple, its cash management solution that’s offered within the same robo-advisor app. It is a very low risk alternative as investments go towards the AmIncome Fund, which has a proven track record of above 3 per cent interest in the past five years. StashAway Simple offers returns of up to 2.4 per cent per annum, while giving investors the freedom to withdraw funds in three to four business days without incurring penalties. The fund management fee is 0.5 per cent per annum.

Available on: App Store, Google Play and Huawei App Gallery

For more information, visit the website.

2. Versa

Versa launched in January this year, offering returns on par with fixed deposits (FD), while providing the option to withdraw funds at a day’s notice without penalties. The minimum deposit is only RM1 to start earning up to 2.4 per cent interest per annum. Deposits will be invested in the MMF Affin Hwang Enhanced Deposit Fund, which has shown consistent returns of between 2 to 4 per cent in the past five years. Investors will receive daily interest returns credited in the form of biweekly payouts. Versa charges a fund management fee of 0.3 per cent per annum and a trustee fee of 0.05 per cent per annum.

Available on: App Store and Google Play.

For more information, visit the website.

Read more stories on investment here.

| SHARE THE STORY | |

| Explore More |