Malaysia income tax: Here are the tax reliefs to claim for YA 2022

Taxing duties

It’s tax season again! With the due date for the submission of Form BE for Year of Assessment 2022 set on 30 April 2023, it’s best to start early. First things first, let’s clarify who needs to file an income tax return in Malaysia. If you’re a Malaysian resident, you’ll need to file a return if your income for the year 2022 was more than RM34,000. If you’re a non-resident, you’re taxed at a flat rate of 30 per cent and are not eligible to enjoy any reliefs.

Here’s a quick rundown of what you can claim for tax rebate:

Self, spouse and parents

Individual and dependent relatives: RM9,000

This will automatically be included as tax relief for individuals and their dependent relatives.

Husband/wife/payment of alimony to former wife: RM4,000

For those with a spouse who has no source of income or doesn’t earn a taxable income. This applies to husbands who pay alimony* to their ex-wife as well.

*Note that you’ll need formal agreements to prove this arrangement.

Medical expenses for parents: RM8,000

If you are paying for your parents’ medical treatment, special needs and/or carer expenses, you’re eligible to claim up to RM8,000. However, it has to be for a medical condition that requires specific treatments and can be certified by a medical practitioner.

Education and medical

Education fee (self): RM7,000

Applicable for:

- Other than a degree at masters or doctorate level—Course of study in law, accounting, Islamic financing, technical, vocational, industrial, scientific or technology

- Degree at masters or doctorate level—Any course of study

- Course of study undertaken for the purpose of upskilling or self-enhancement (Restricted to RM2,000)

Medical expenses: RM8,000

- For serious diseases* for self, spouse or child

- Medical expenses for fertility treatment for self or spouse

- Complete medical examination for self, spouse, child, including Covid-19 detection test, vaccination and mental health examination or consultation (restricted to RM1,000)

*Examples of “serious diseases” include AIDS, Parkinson’s disease, cancer, leukemia, heart attack, major organ transplant, etc.

SSPN (Net deposit): RM8,000

Individuals are given an income tax relief up to RM8,000 until YA 2024 for net annual savings in SSPN. Other student debt reductions assistance include:

- 20 per cent off outstanding PTPTN loan balance upon full settlement between 1 November 2022 to 30 April 2023

- 15 per cent discount off outstanding PTPTN loan balance for debtors who pay off at least 50 per cent of their remaining debt in a single payment or opt for salary deduction or scheduled direct debit between 1 November 2022 to 30 April 2023.

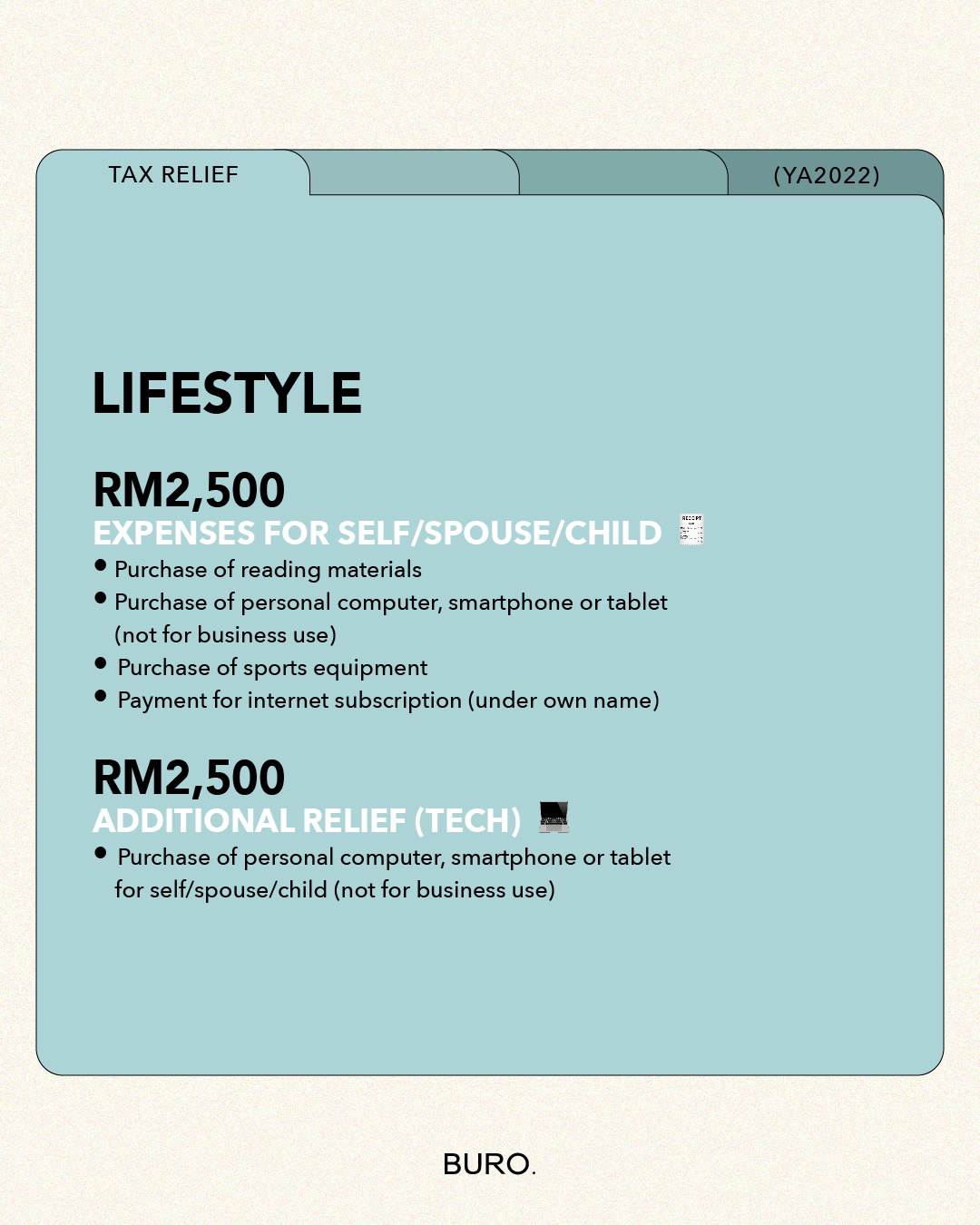

Lifestyle

For self, spouse or child: RM2,500

This category applies to:

- Books, journals, magazines, printed newspapers and other similar publications

- Personal computer, smartphone or tablet

- Payment of your monthly internet bill/subscription (under own name)

- Gym memberships and purchase of sports equipment (for sports activity defined under the Sports Development Act 1997)

Tech: RM2,500

An additional relief if you purchased a computer, smartphone, or tablet for your own use/benefit or for your spouse or child and not for business use.

Sports equipment: RM500

This additional relief is for:

- Purchase of sports equipment

- Rental/entrance fee to any sports facility

- Registration fee for any sports competition

Domestic travel expenses: RM1,000

Don’t forget to claim this tax relief if you’ve stayed at an accommodation registered with the Commissioner of Tourism OR paid entrance fee(s) to a tourist attraction. You can also claim for your domestic travel packages that are purchased through licensed travel agents with the Commissioner of Tourism under the Tourism Industry Act 1992.

Parenthood

Purchase of breastfeeding equipment: RM1,000

This relief is restricted to female taxpayers for their children who are two years old and below. Do note that this deduction is allowed once in every two years of assessment.

Child (below 18 years old): RM2,000

Each unmarried child who is under the age of 18 years old.

Note: This can only be claimed by either the mother or father.

Child (18 years old and above): RM2,000

Each unmarried child who is 18 years old and above, and who is receiving full-time education (A-Levels, certificate, matriculation or preparatory courses).

Note: This can only be claimed by either the mother or father.

Child (18 years old and above): RM8,000

Each unmarried child who is 18 years old and above, and who is pursuing tertiary education:

- A diploma or higher (excluding matriculation/ preparatory courses) in Malaysia

- An undergraduate, Master’s, or Doctoral degree (or its equivalent) from overseas

- Any courses at institutions of higher learning recognised by the Ministry of Higher Education (MOHE).

Childcare fee: RM3,000

This deduction can only be claimed by either the mother or father if the child (below six years old) is attending a registered childcare centre or kindergarten.

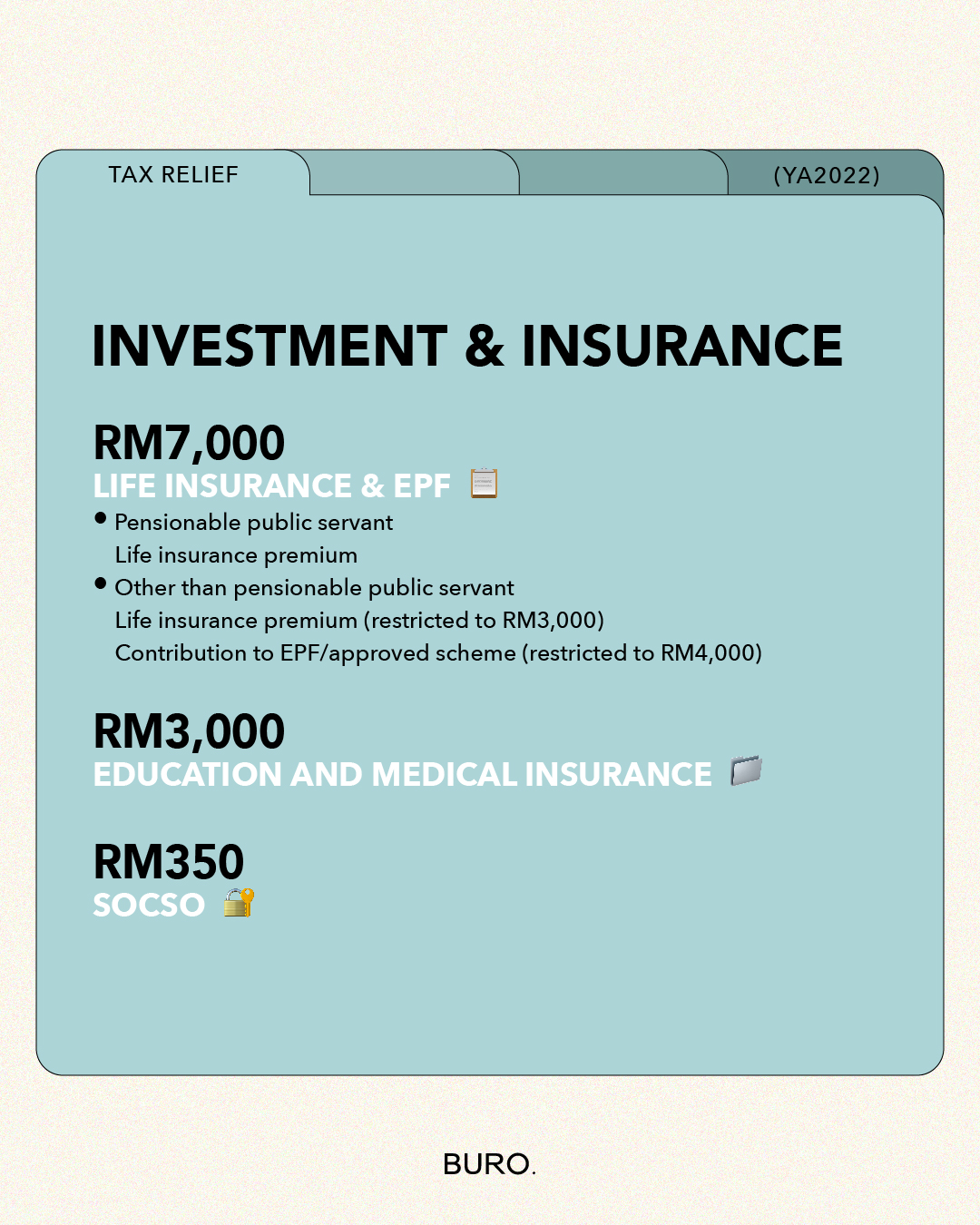

Investment and insurance

Life Insurance and EPF: RM7,000

This is divided into:

- Pensionable public servant category—Public servants can claim up to RM7,000 for their life insurance premium

- Other than pensionable public servant category—Non-public servants can claim based on two sub-categories: Life insurance premium (≤RM3,000) and EPF (≤RM4,000)

SOCSO: RM350

Tax relief for SOCSO contributions is increased to RM350 and expanded to include the employee’s contributions through the Employment Insurance System.

Deferred annuity and private retirement scheme: RM3,000

Individuals who make contributions to their PRS funds are allowed to claim personal tax relief of up to RM3,000 by the Inland Revenue Board of Malaysia, which is available until assessment year 2025. Whereas for a deferred annuity, only the annuity premiums are entitled to tax relief.

Education and medical insurance: RM3,000

This is different from your life insurance premium. It is claimable if you paid for any insurance premium related to education or medical for yourself, spouse or child.

Expenses on charging facilities for Electric Vehicle (Not for business use): RM2,500

These expenses include your hire purchases and subscriptions.

Disabilities

Disabled individual: RM6,000

This tax relief is applicable to individuals who are disabled and registered with the Department of Social Welfare (JKM).

Disabled spouse: RM5,000

This tax relief is applicable to individuals’ spouses who are disabled and registered with the Department of Social Welfare (JKM).

Disabled child*: RM6,000

Regardless of age.

*If your disabled child is 18 years old and above, unmarried, and pursuing higher education in Malaysia or overseas, you can get an additional exemption of RM8,000.

Basic supporting equipment for disabled self/dependants: RM6,000

Purchases of supporting equipment for disabled self or dependants (disabled spouse, children or parents) are eligible for a tax relief of up to RM6,000. However, similarly, the disabled individual/dependant(s) have to be registered with the Department of Social Welfare (JKM).

Keep your receipts and for an extra safety measure, scan them

Important tip: Make sure you keep all receipts for everything mentioned above—even after you’ve filed your income tax. You never know if the Inland Revenue Board will choose you for an audit, so having these receipts will at the very least help to back up your claims and avoid any penalty fees. The general rule is that they must be kept for at least seven years from the date of filing. Organise and scan them to be uploaded online as a backup in case it goes missing or the ink from the receipts fade away.

For more info, visit the Lembaga Hasil Dalam Negeri website.

| SHARE THE STORY | |

| Explore More |