Long gone are the days when we had to visit the bank to make payments or wait a few days to see a reflection in our bank account balance. From digital wallets to contactless payments and cryptocurrency (albeit not legal tender in Malaysia as of yet), there’s now a multitude of options to make the payment process more seamless and convenient.

Recently, “Buy Now, Pay Later” (BNPL) services have been making waves in the payments landscape. While not new in the global market, the rise of e-commerce and the pandemic-induced push for alternative payment platforms have accelerated the BNPL trend in Malaysia.

For the uninitiated, BNPL platforms work similarly to credit card instalment plans. When making a BNPL transaction, a BNPL provider will “buy” the item from the merchant at a discount—also known as the provider’s cut—and the consumer then pays the BNPL provider in instalments. This allows consumers to make larger payments without busting their monthly budgets, thus providing access to a wider range of products and services.

Better yet, most BNPL providers do not conduct credit checks or charge interest to consumers, which makes them more appealing than typically long-winded credit card applications. Sold by the idea? Take a look at five key BNPL players in Malaysia and how they’re making shopping more accessible.

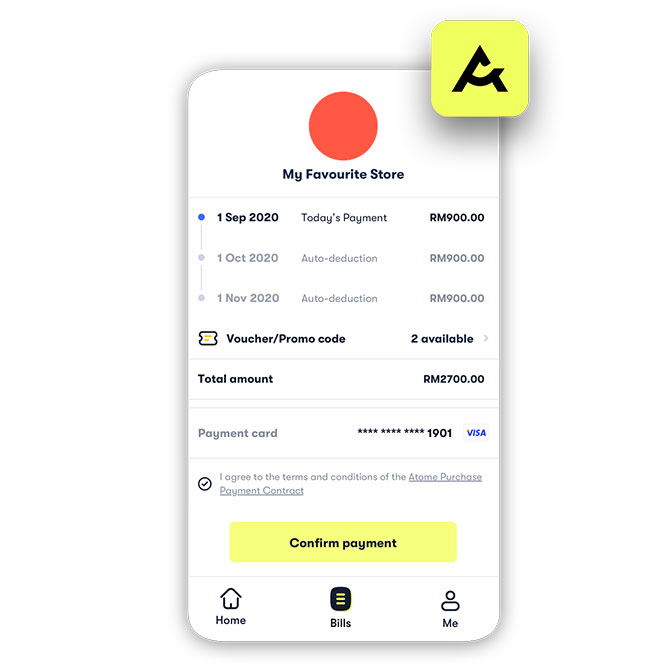

Atome

Launched in Singapore in 2019, Atome (pronounced a-toe-me) is one of Asia’s largest BNPL platforms today. It partners with over 2,000 leading online and offline retailers across fashion, beauty, lifestyle, fitness, and homeware categories spanning Singapore, Malaysia, Indonesia, Hong Kong, and mainland China.

Atome automatically splits all bills into three equal payments, the first of which will be made at the point of purchase. The following two payments will be spread 30 days apart, with no hidden fees or interest. Users can also track and manage monthly spending or shop directly via the Atome app, available for download via the App Store and Google Play.

For more information, visit the website.

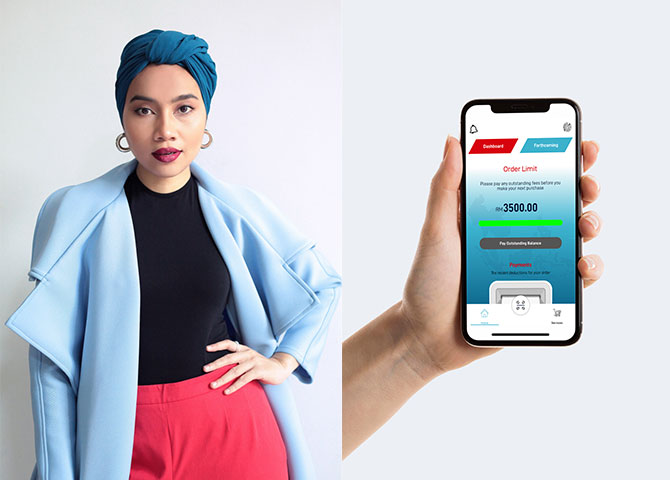

myIOU

One of the newest BNPL platforms on this list is myIOU, launched by IOUpay—a public listed fintech company on the Australia Stock Exchange (ASX) since June 2021. It recently generated buzz after naming US-based Malaysian singer-songwriter Yuna as its brand ambassador, who will be fronting its campaigns and promotional activities across online and offline platforms.

With myIOU, consumers can split their purchases into two, three, or six payments with zero interest. Malaysians aged 18 years and above with access to a local debit or credit card can register for an account and receive instant credit approval of MYR1,000 for purchases from approved merchants. The app is now available for download via the App Store and Google Play.

For more information, visit the website.

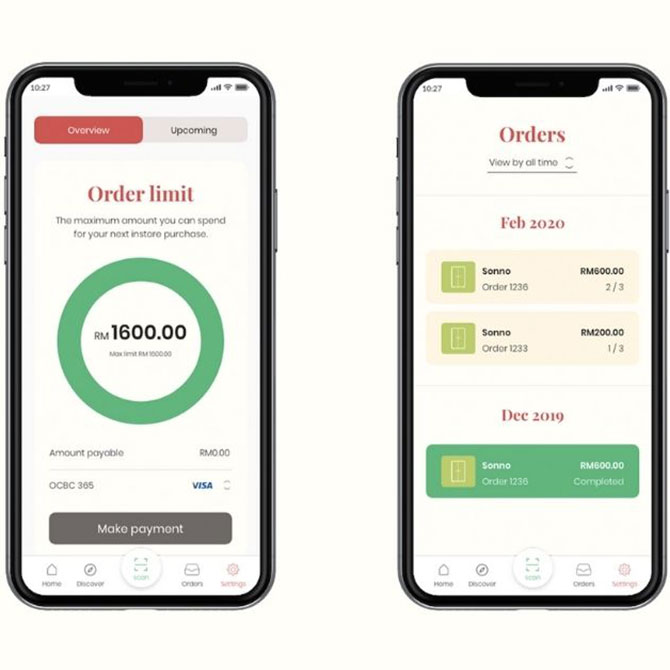

Hoolah

Hoolah is another Singapore-based fintech startup that was established in 2018, before entering Malaysia the next year. It is currently operating in both countries and Hong Kong, with plans to expand to Thailand and Philippines later this year. Among its local and global partners include Clarins, Nike, the dUCk group, Gung Jewellery, and more.

It allows consumers to split bills into three equal instalments over three months with zero interest and no additional fees. To use the service, simply choose Hoolah as your payment method during checkout and fill up a quick application form (for first-time users) with your debit/credit card details and you’ll automatically receive reminders three days before your next payment due date. You can also shop and manage payments via the Hoolah app, available on the App Store and Google Play.

For more information, visit the website.

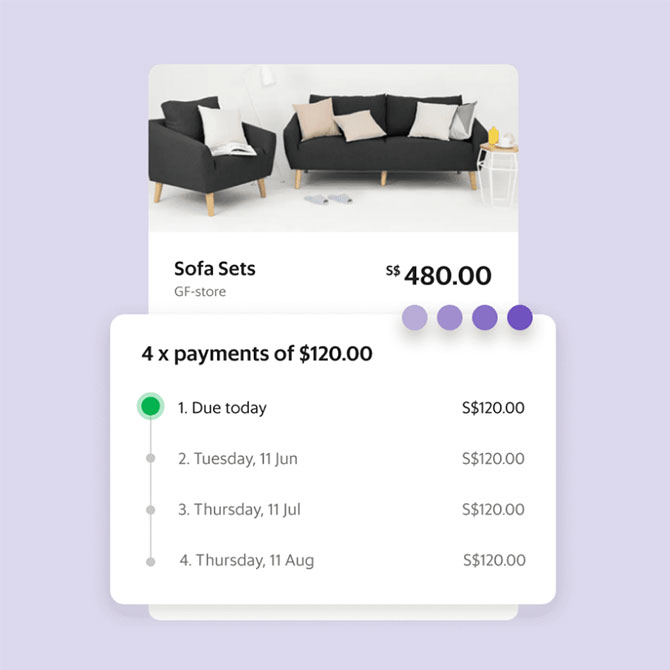

PayLater by Grab

E-hailing turned superapp Grab launched its BNPL service in 2019, known as PayLater by Grab. PayLater is available with all Grab rides, GrabFood/Mart orders, and online purchases made using GrabPay. There are two ways to use PayLater. One option is to split large bills into four payments. Alternatively, consumers can consolidate all their bills and pay them all-in-one the following month. Grab does not charge any interest or upfront fees, as long as you pay on time.

To be eligible for the service, consumers must fulfil the following requirements:

- 21 years and older

- Platinum, Gold or Silver GrabRewards tier member

- Active Grab consumer using cashless payments

PayLater is available via the Grab app on the App Store and Google Play.

For more information, visit the website.

PineLabs

Unlike the rest on this list, PineLabs’ Buy Now Pay later services are primarily offline. The Indian merchant platform partners with banks and other payment services to offer Pay Later EMI (equated monthly instalments) through its PoS (point-of-sale) terminals. Currently, Pine Labs works with top banks including AmBank, Affin Bank, CIMB Bank, and RHB Bank, to name a few.

For consumers, this means merchants that use PineLabs’ Pay Later service will allow you to split your bill on-the-spot when you check-out your items in-store. There’s also a catalogue on the PoS device to allow you to pick your preferred plan, which works with both debit and credit cards.

For more information, visit the website.

Read more on finance here.

| SHARE THE STORY | |

| Explore More |